While temperatures stay low, demand for refinance loans remains high. According to the Mortgage Bankers Association (MBA), for the week of February 19th, refinance mortgage loan volume represented the majority of loan applications, with a 68.5% share. More importantly, the share of refinance loan volume was up 50% year over year (YOY). In the current low-rate environment, Millennial homeowners are the leading consumer demographic scaling the refinance market.

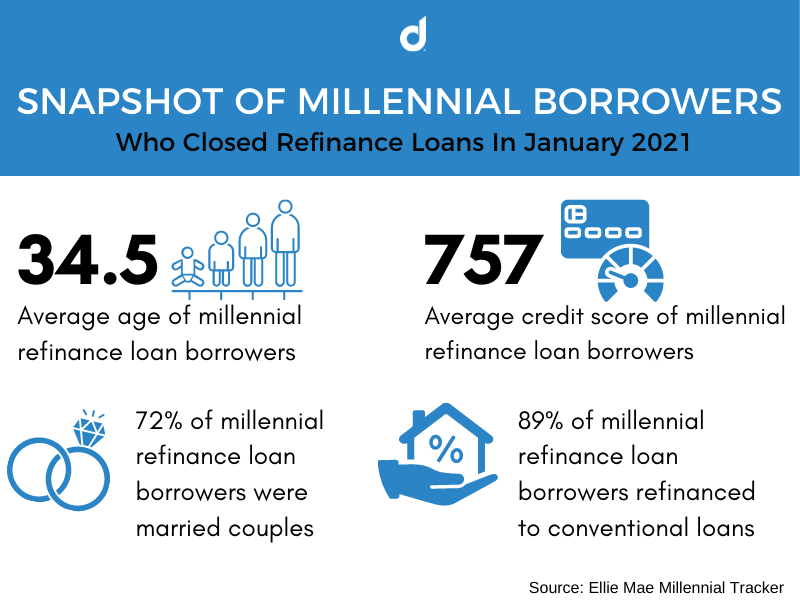

Snapshot Of Millennial Refinance Loan Borrowers In 2021

Overall, mortgage interest rates for the 30-year fixed rate, 15-year fixed rate and 5/1 ARM loan products have experienced a downward trend since December 2018, and the favorable mortgage interest rate climate has been the primary driver of consumer intent for refinance loans. Even with recent slight rate fluctuations, mortgage interest rates have recently remained below 3.5% – which is extremely attractive for many homeowners who closed their purchase loans at higher interest rates. According to the Freddie Mac Primary Mortgage Market Survey, in the last decade, mortgage interest rates have only held steady below 3.5% twice before – the periods of August to May in 2013 and June to October in 2016. As interest rates remain near historic lows, consumers are capitalizing on the benefits of refinance, with Millennials representing the most dominant borrower segment.

The Ellie Mae Millennial Tracker divides consumers born between 1980 and 1999 into two segments, Old Millennials (ages 30 to 40) and Young Millennials (ages 21 to 29). Since 2014, the Ellie Mae Millennial Tracker has mined demographic data to analyze closed loan application trends and mortgage loan application volume of these Millennial borrowers. Heading into 2021, interest rates hovering near record lows continue to attract Millennial homeowners.

According to president of ICE Mortgage Technology, Joe Tyrell, “With interest rates reaching historic lows, Millennials have refinanced to take advantage of a significant savings opportunity they will see play out over the long-term. Lenders are continuing to manage the refinance pipeline by investing in virtual solutions such as eClosing, online borrower portals and virtual verifications, and turning this boom in loan volume into business growth.”

Student Loan Debt Drives Millennials To Explore FHA Refinances, Despise PMI

Many Millennials who purchased homes in the last decade experienced the struggle of inventory shortages and interest rates above 4%. Additionally, according to data from the Federal Reserve, student loan debt has doubled in the U.S. since 2010. As a generational segment heavily and negatively impacted by student loan debt, Millennial homeowners can uniquely benefit from a mortgage refinance. Because of flexible loan criteria and a lower down-payment threshold, the FHA has been a popular loan choice among Millennials for many years, even though FHA mortgage loans often come with the added cost of PMI. Combined, Millennial homeowners are highly motivated to refinance in an effort to reduce monthly expenses. For many Millennials, refinancing is a way to take advantage of monthly savings on their mortgage costs and apply more funds toward cutting down student loan debt.

How Mortgage Marketers Can Better Engage Millennial Homeowners

With the surge of record-breaking refinance volume experienced in 2020, many mortgage marketers might feel they have already engaged all eligible homeowners in their databases on refinance opportunities. The truth is, while many Millennials have already refinanced their former home loans, many are refinancing again. Plus, there is still a population of eligible homeowners that has not refinanced recently.

Here are three ways mortgage marketers can better connect with high-intent Millennial homeowners seeking refinancing loan options.

1. Leverage First-Party Channels To Reassure Millennials They Can Afford Refinance Closing Costs

A top concern among Millennial consumers is affordability. As the generation that has experienced the Great Recession, two major periods of unemployment, student loan debt and now a global pandemic, the fear of economic uncertainty is a dominant pillar of Millennials’ approach to major financial decisions. Although refinancing often represents savings opportunities, Millennials may be concerned about the added expense of closing costs. Mortgage marketers have an opportunity to anticipate and address Millennial concerns by positioning consistent messaging across their websites, social media pages, email communications, landing pages, microsites and other first-party channels to promote opportunities to include loan closing costs into the loan repayment terms. Mortgage marketers should evaluate the copy and creative on their channels with a simple question, “Does this make me believe the refinance loan process is affordable?”

2. Use Organic & Paid Social Content To Promote The Digital Refinance Loan Process

Another factor that may be discouraging Millennials from taking the first step toward refinancing is the fear of complicated, in-person loan application processes. Mortgage marketers should leverage organic and paid social media posts to inform their target audiences of the seamless, digital refinance loan process offered by their brand. More and more consumers are relying on social media as a research tool in advance of major transitions or decisions. According to Mortgage Professional America (MPA) magazine, Millennials use social media sites, like Instagram and Facebook for research, consideration and decision making more than Gen Xers and Boomers do. By using social media in-platform video functions, like Facebook Live and Instagram Reels, mortgage marketers can be resources for Millennial refinance-related mortgage questions and provide information through engaging formats. Paid social media content should direct high-intent Millennial homeowners to simple landing pages that enable the submission of inquiries, letting prospective borrowers begin the loan process without friction or delay.

3. Review & Test Copy, Creative & Timing In Refinance-Related Automated Emails

To connect, engage and drive refinance mortgage loan applications and inquiries, mortgage marketers can leverage automated email marketing strategies, even when rates experience fluctuations. Email marketing can help mortgage marketers engage Millennial homeowners in more personalized and actionable ways. During the email campaign analysis, mortgage marketers should review copy, creative, CTAs and scheduling to identify the combination that delivers the best conversion rates.

Seeking New Ways To Maximize Your Customer Acquisition?

Digital Media Solutions (DMS) is a technology-enabled, data-driven performance advertising solutions provider connecting consumers and advertisers. Contact DMS today to learn how our first-party data asset, proprietary technology and expansive digital media reach can help you scale your customer acquisition results.